With many businesses still operating remotely due to the pandemic, many small businesses (and even larger corporations) can maximize things like taxes and more. But with everything going on, you need some entertainment in the workplace that can be networked together. You’ll often notice companies paying high prices for satellite and local cable television, but you may not even know that this isn’t necessary! You can save a ton of money and still have a deductible business expense on certain business services you offer to your employees while using streaming services!

Table of Contents

What Are Deductible Subscriptions?

If you would rather save money, but use streaming services such as Netflix, Hulu, Philo, and others, you may be able to count them as a business expense. Most of us, even business owners, have Smart-TVs now or Roku TVs. If you do in your place of business, you can always add these services for your employees’ entertainment, or even if you use things such as YouTube Premium subscriptions so you can broadcast material, you can add those. Here’s the catch:

They MUST be used only for business. That’s right – unless you’re a self-employed individual and pay for services, these accounts have to be used only at your place of work, for business purposes. It can get a bit sketchy, but this also means you can’t use your business accounts to search and watch your favorite videos on YouTube or the next Game of Thrones Episode at home using your business accounts.

Streaming Music Can Be a Business Expense Too

Most marketing agencies creating original content use music streaming services such as Spotify or iTunes to use in ads and videos. But did you know that if you have on-hold music installed on your VoIP system that it is a business expense, you can write off? Since it’s a music streaming service and you are using said music to keep customers entertained, it is deductible.

Rather than paying for Sirius, XM Radio, or other more expensive streaming services, you can use things such as iTunes, Spotify, and other services as a solid business expense as well. This also includes VoIP services that you may have patched into these accounts (to provide hold music for your customers). If you want to have a business in which you have public music broadcasting for customers, patients, and even strictly for your workers, audio streaming services can also be added to your business expenses – and they too can be tax-deductible!

Again, it would be best if you only had this for your business. Not for your listening pleasure at home or anywhere else.

What About Amazon?

One that’s not necessarily a streaming service, but more of a subscription service is Amazon Business Prime. For any business wondering, if the cost of a Prime membership is worth it, it is, and it is a deductible business expense.

Other services, including Amazon, have business-specific services that allow you to use strictly for business. When you get one of these services, such as Amazon Business Prime, you can deduct that at the end of your year because it’s a valid business expense.

What Other Services Count as Streaming Services?

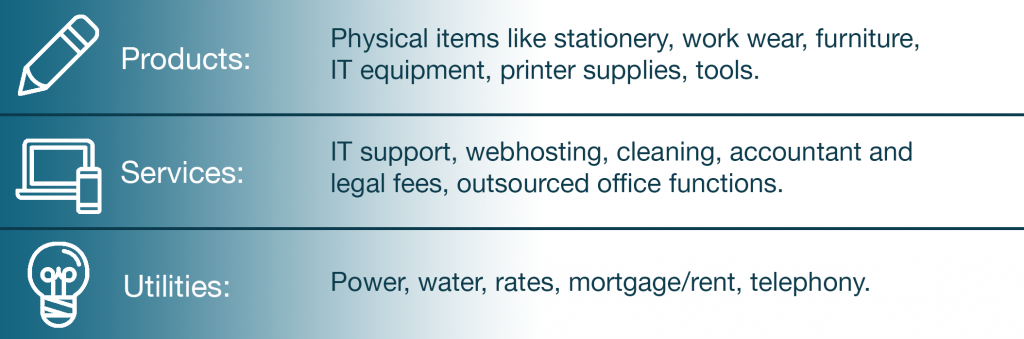

Not all of these are streaming services, but they all are tax-deductible, and you should be claiming all of them.

Other services, such as file backups, cloud backup solutions, IT department solutions, and even managed service providers count as a business expense for you. This will help give you a massive break in many ways throughout the year, not just at tax time.

Do Web Hosting Services Count?

Web hosting is counted as a streaming service, and as a business expense can be written off.

This is also deductible, but you want to make sure that you get a good web hosting provider. One of the best things you can do to avoid having numerous bills is to ask your MSP or IT technical support team to provide these services. The best ones offer skills that can adapt to any situation, any business, and on multiple levels. With the right MSP, you can even use your mobile phones, websites, and more to help stay connected to your employees.

Are Long-Term Service IT Contracts Deductible Business Expenses?

A long term service agreement with your MSP is tax-deductible. So are streaming services like iTunes or Spotify if you pay for them in advance.

When it comes to no-hassle services, some may offer a contract-based business relationship, while others are simply word-of-mouth even when they’re paid “month to month.” Many small businesses will either enter long-term contracts with their providers, so they don’t have to deal with the hassle of continually re-upping their subscriptions. For things like Spotify and other streaming services, a lot of times, you can call their customer support line and do this as well. Even Amazon Prime can let you pay for an entire year’s worth of service (vs. month to month).

To consider streaming services into your annual expenses, if you pay for more than a year (like paying for a contracted technical representative team for five years), you can divide it by the amount of time to calculate it into your yearly expenses.

What’s the Point?

The point of this post is to educate you and all of our clients here at Infinity DataTel of how business expenses work and show you how to save some money. By hiring the right team of professionals that can give you the best services on multiple levels – and provide various IT services to you at the same time, you can get a majority of the above streaming features and so much more! Allowing you to get the most out of your company’s money and worry about what’s important – the business!