As you already know, we are living in a digital era. But as accounting firms embrace new technology, they need to be aware of the increase in cyber threats and their regulations. Digital change has taken over the financial services industry, and accounting firms are no stranger to this technological change.

In an earlier article by Gartner, the most significant challenges for accounting CIOs in 2019 were “digital.” Like many sectors, financial services organizations are looking to enhance their procedures. They are optimizing their company models and offering a much better client experience. They are using mobile apps, artificial intelligence, and the cloud to do this.

Table of Contents

Cybersecurity Regulations

New York has enacted a set of cybersecurity regulations, and Arizona could be next. This may not affect Arizona accounting firms right now but most likely will in the not too distant future.

In 2018, New York State launched a cybersecurity regulation named 23 NYCRR 500. It requires all organizations reporting to the Financial Services Department to “evaluate their specific risk profile and design a program that robustly addresses their risk.” And while accounting firms are not directly affected by this mandate, many of their clients are. Therefore, if they are to work with these types of businesses, they must also embrace the criteria described in this legislation.

New York might have been the first to roll out a regulation such as this one, but it certainly won’t be the last. South Carolina, Ohio, and Michigan have also enacted data security laws for insurers over the past year. Arizona has not passed any regulations yet but may do so in the coming months. As laws and regulations emerge across states for different financial services industries, firms need to make sure they are on top of these changes and using the most stringent code as their baseline for meeting compliance.

Minimizing Damage

Accounting firms need to be on high alert when it comes to phishing scams. Falling for a phishing scam could have massive financial repercussions.

Accounting firms need to focus on keeping their clients out of harm’s way. They need to work extremely hard to prevent cyber attacks. If they fail to do so, hackers will discover how to obtain access and wreak havoc on their network.

Social engineering has made phishing scams incredibly tricky for the average employee to detect. New vulnerabilities are continually being exploited. Cybercriminals are continuing to find creative ways to break in. To keep information secure, minimize danger, and neutralize the effect of an assault, companies may want to look into investing in a high availability solution.

Overcoming downtime and data breaches

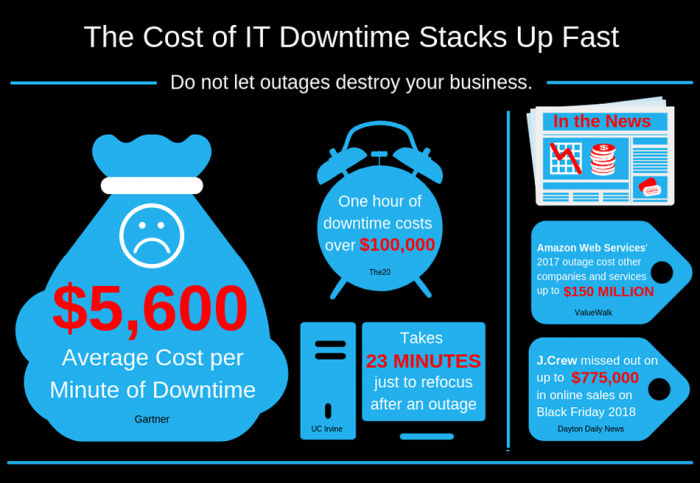

Downtime can cost businesses thousands of dollars per minute. How many hours of downtime can your accounting firm afford to lose?

High availability technology continually replicates real-time files, systems, and apps and generates retrieval points. They are taking the retrieval element out of the equation entirely. If a system is knocked offline, businesses should go into failover mode automatically. Everything should be the way it was before the incident. It is effectively neutralizing the attack altogether.

It can be costly to be offline, even for a few minutes. The average cost of downtime is around $5,600 per minute. That price tag does not even include regulatory penalties that could be incurred. You may also be responsible for the cost of carrying out forensic assessments. Another effect associated with being involved in a data breach is lost customer confidence. A survey by Varonis shows only 17% of customers stay with financial institutions after a breach. Can you afford to lose 83% of your customers?

With evolving regulations and cyber threats, information technology should be a top priority for accounting firms. Accountants that do this will be better equipped to mitigate downtime, neutralize assaults, and keep their customers out of the crossfire.

For more information about how your accounting firm can keep its customers safe, send a message. We’d love to share the latest security methods and software with you and your team!